Sunday Evening Post #88

I forgot to post last week, and this is getting up late tonight (mostly because there are still people in my house playing Last Night on Earth). Not a lot got accomplished in March, partly because I became 95% certain I would be losing my job early in the month and most of my energy has been focused on starting the job hunt and going over finances with C.

I forgot to post last week, and this is getting up late tonight (mostly because there are still people in my house playing Last Night on Earth). Not a lot got accomplished in March, partly because I became 95% certain I would be losing my job early in the month and most of my energy has been focused on starting the job hunt and going over finances with C.

Blogging

The purpose of these two goals is, yes, to grow my blogs, but also to support and highlight blogs and bloggers I enjoy. Just like I will be posting 2 new to me blogs every week in my round ups, the point here is to draw attention to blogs that others might not be familiar with. (Blog swaps will not count toward either of these goals.)

Write one guest post per month.

January- yes

February- yes

March – no

Publish one guest post per month.

January- yes

February- no

March – no

Pretty much a big fail for the entire month.

Writing fiction is my side hustle, though I have yet to make any money from it. I’ve found that I devote much more time to the blogs than I do my fiction, though, because I am on a schedule. I feel accountable to my readers to get posts up when I say I will. And because I am a procrastinator, deadlines are a must for me. I get the energy I need to work on something from an impending deadline.

I am hoping to transfer the power of those two things- accountability and deadlines, to my fiction this year.

Submit at least one piece to a paying venue per month.

December: Yes (rejected)

January: Yes (rejected)

February: Yes x4 (1 rejection)

March: No

Complete the first draft of my novella and start edits.

Finances

A lot of financial goals will actually end up as floating goals- ie they will be things I expect to complete well before the year is out. But I do have some long term financial goals that I think will work for year-long tracking.

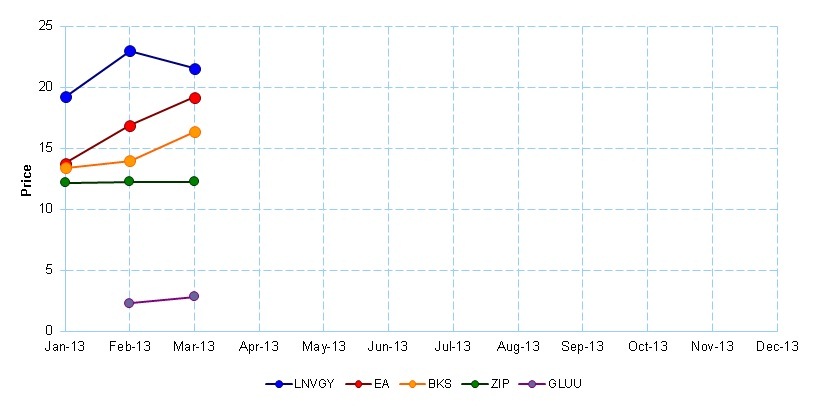

Create and track a practice stock portfolio. My next post is so going to have a ton of “extra” analysis thanks to my computational finance course.

End the year “on budget” in the categories I’m tracking.

Final March Numbers

|

Category |

On Budget |

|

|

Month |

Year |

|

|

Groceries |

No |

No |

|

House |

No |

No |

|

Eating Out |

No |

No |

|

Allowance – E |

Yes |

Yes |

|

Allowance – C |

Yes |

Yes |

And now we’re going to make things even more complicated, budget wise, as we got the CostCo American Express. I’m thinking I may put all groceries on it and just pay the bill once a month. It will mean that groceries only get tracked once a month, though, so we’ll see.

Earn my Certified Supply Chain Professional designation. I have the study guide. Mostly, I need to book my testing date to make myself study.

Get a new job.

Rebuild savings to $5-10k. .

Replace all the windows in the house. We got the information for the vendor Direct Buy contracts with for window replacement. Next step will be to get someone out to give us a quote.

Fix the plumbing issues. We have a number of little plumbing issues all of which we really need to get fixed.

Publish new photography/flash fiction book. My artist is in. Now we just need to start working out the logistics.

Refinance the house. DONE.