The Stock Market Project – Month 3

March- time to throw another imaginary $200 at the stock market. And this month, I need it to be imaginary, as we really don’t have $200 to spare. (Well, we do, but then our savings would be even more miserable, and I don’t think I could actually bring myself to invest if I weren’t comfortable with my cash savings levels, even if the investment has the potential to bring in more money.)

Last month, I announced my desire to buy at least one share of Amazon stock. I am still excited about what they are doing, and so I saved my money. And, I am apparently not the only person excited as last month it was going for over $260/share (in January, when I started this, it was at $266/share). I “bought” my one share today at $273.63. I just have to hope it keeps going in the right direction.

I know one share seems silly, but since the point of this project is to help me figure out what I want to do when I do get to a point I could invest in individual stocks, I’ll have a better idea if I think the high priced stocks are worth it or not.

The “big” news this month is that I’ve decided (as much as I can without ever using their interface) that e*trade is not for me. I’ve determined that I’d rather go with Scottrade. Why? Trades are only $7 at Scottrade, vs. $9.99 e*trade. At a savings of $3/trade, this allowed me to retcon last month’s purchase of Glu Mobile (GLUU) stock to 25 (up from 20) shares and still have more money left over than I would have paying e*trade’s price per trade.

I know I couldn’t do this in real life, but that’s the point of running the experiment for a year first. I get to figure out the best option for me in a way that lets me make changes like this.

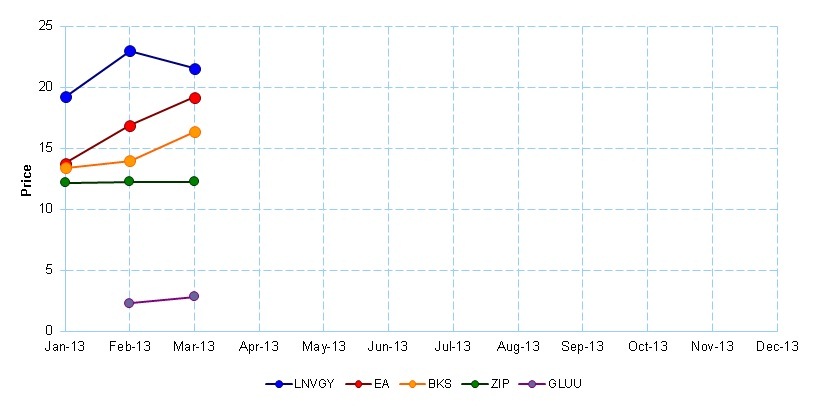

What else is going on? Well, we all probably heard that the stock market reached a new record high last week, and all of my stock choices reflect that. I am up, pure stock price (not counting my trade expenses) over $100. ($58, once the $7/trade has been figured in.) Lenovo (LNVGY) went down a little from last month, but is still up from when I bought it in January. EA (EA) and Barnes & Noble (BKS) both had jumps of over $2/share since February. Zip Car (ZIP) is holding steady, and my cheap buy from last month, Glu Mobile (GLUU) rose by $0.50/share. That might not seem like much, but it’s over a 20% increase, which actually makes it my biggest mover.

| Stock | Shares | Buy Price | Buy Value | Transaction Cost | Current Price | Current Value | Profit/(Loss) |

| LNVGY |

5 |

19.22 | 96.10 | 7.00 |

21.55 |

107.75 |

4.65 |

| EA |

9 |

13.77 | 123.93 | 7.00 |

19.17 |

172.53 |

41.60 |

| BKS |

9 |

13.40 | 120.60 | 7.00 |

16.33 |

146.97 |

19.37 |

| ZIP |

9 |

12.16 | 109.44 | 7.00 |

12.25 |

110.25 |

(6.19) |

| GLUU |

25 |

2.29 | 57.25 | 7.00 |

2.8 |

70.00 |

5.75 |

| AMZN |

1 |

273.63 | 273.63 | 7.00 |

273.63 |

273.63 |

(7.00) |

| TOTAL | $780.95 | $881.13 | $ 58.18 |

The one stock that I really need to keep an eye on for news is Barnes & Noble (BKS), as there is talk of it being split into two different companies with the brick and mortar stores being taken private, and the online store and Nook team remaining publicly traded. I have no idea what that will mean buy out and stock price wise, so I’ll need to pay attention.

AMZN is not shown on this chart as it’s stock price is over 10x that of any of the others, making the rest of these really squish together on any chart that includes it.

[…] and track a practice stock portfolio.Post went up on Tuesday. And just a warning, I’m currently taking a computational finance course […]