Sunday Evening Post #97

When it comes to the goals listed in this post, it’s going to look like I should just write the month of May off as a total failure. But personally, I’m counting May as a resounding success. It was our first month of parenthood. We managed a family road trip that included the dogs. I have spent the entire month unemployed and not driven anyone crazy, plus have had some solid interviews.

When it comes to the goals listed in this post, it’s going to look like I should just write the month of May off as a total failure. But personally, I’m counting May as a resounding success. It was our first month of parenthood. We managed a family road trip that included the dogs. I have spent the entire month unemployed and not driven anyone crazy, plus have had some solid interviews.

Blog goals and writing goals have fallen a bit behind. And I am okay with that. Life requires readjustment.

Blogging

The purpose of these two goals is, yes, to grow my blogs, but also to support and highlight blogs and bloggers I enjoy. Just like I will be posting 2 new to me blogs every week in my round ups, the point here is to draw attention to blogs that others might not be familiar with. (Blog swaps will not count toward either of these goals.)

Write one guest post per month.

January- yes

February- yes

March- no

April- no

May- no

Publish one guest post per month.

January- yes

February- no

March- no

April- no

May- no

I do have a request in with one blogging friend to write a guest post for me, so hopefully I’ll get that soon.

Writing

Writing fiction is my side hustle, though I have yet to make any money from it. I’ve found that I devote much more time to the blogs than I do my fiction, though, because I am on a schedule. I feel accountable to my readers to get posts up when I say I will. And because I am a procrastinator, deadlines are a must for me. I get the energy I need to work on something from an impending deadline.

I am hoping to transfer the power of those two things- accountability and deadlines, to my fiction this year.

Submit at least one piece to a paying venue per month.

December: Yes (rejected)

January: Yes (rejected)

February: Yes x4 (2 rejections)

March: No

April: Yes (rejected)

May: No

Complete the first draft of my novella and start edits. No real writing these last couple of weeks, but I am thinking about what happens next.

Finances

A lot of financial goals will actually end up as floating goals- ie they will be things I expect to complete well before the year is out. But I do have some long term financial goals that I think will work for year-long tracking.

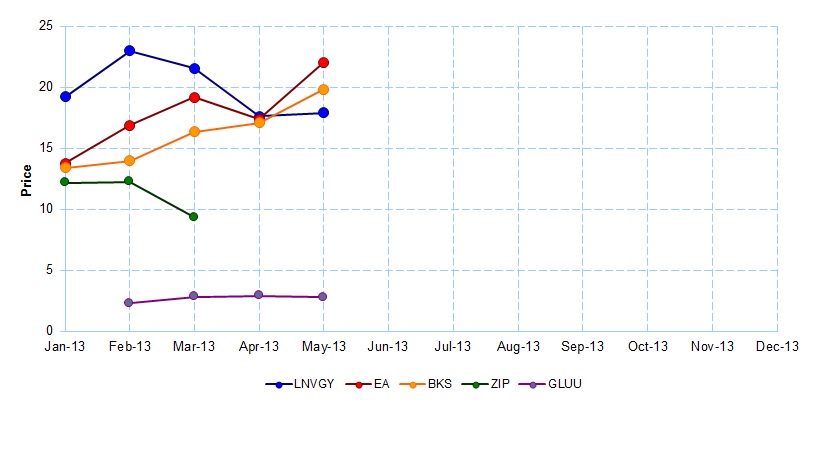

Create and track a practice stock portfolio. On track

End the year “on budget” in the categories I’m tracking.

Final May Numbers

|

Category |

On Budget |

|

|

Month |

Year |

|

|

Groceries |

No |

No |

|

House |

No |

No |

|

Eating Out |

No |

No |

|

Allowance – E |

No |

No |

|

Allowance – C |

No |

Yes |

The budget looks like it went all to hell, but it really didn’t. I completely paid off the credit cards not just from April, but most of May as well (normally would be paid in June), so I think June will show us as being in pretty good shape.

Floating Goals

Find a new job. I’ve had two interviews that I expect to hear more back on next week. And we’re getting to the point where I am expecting to start hearing back on more of the applications I’ve put out. (Since it takes about 4-6 weeks after applying to hear back on many of the jobs I have applied for.)

Replace all the windows in the house. In 4-6 weeks, I will have new windows

Fix the plumbing issues. We have a number of little plumbing issues all of which we really need to get fixed.

Get an Exterminator. Ant season seems to have passed. I still want to get someone out, but it’s less urgent at the moment. And since the ants always come in at the windows, it is possible replacing the windows will end the ants.

Publish new photography/flash fiction book. One of my goals for my “down time” is to start working on this project. Sadly, my down time hasn’t been very down.

Refinance the house. DONE.

Earn my Certified Supply Chain Professional designation. DONE.

Rebuild savings to $5-10k. DONE. (Though savings will actually grow considerably over the next 24 weeks as I get severance and hopefully a new regular paycheck.)