Stock Market Project – Month 5

Turns out that back in mid-March, Zipcar was bought out by the Avis group. Oops, there goes one of my stocks. I never saw any news on how that was handled, so basically, I decided that I had sold it at it’s last value, and was not charged transaction fee. I don’t know if that is how it would actually work, but that’s how I’m playing it.

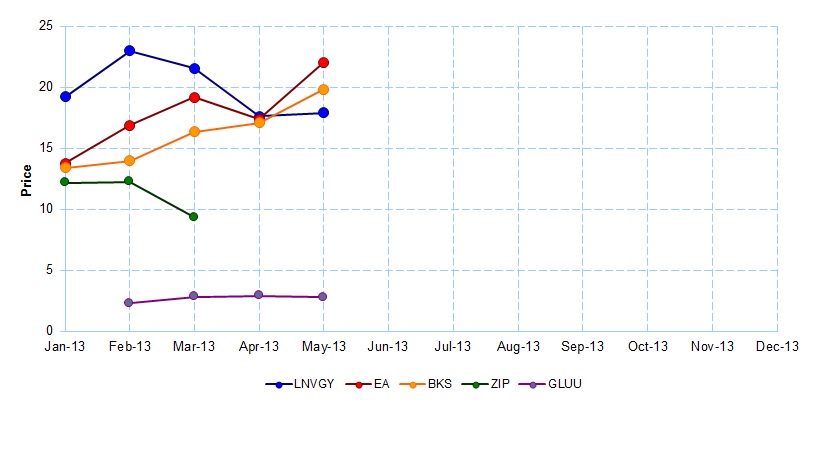

My “smaller” stocks are actually doing quite well. EA and Barnes & Noble are both up nicely. Starbucks is up a little bit, and Amazon is down. I was feeling a little lazy this month, so I used my money to pick up one more Amazon stock, and two more from Lenovo, which is also down from where I originally bought it.

Here’s my chart of where the money stands:

| Stock | Shares | Buy Price | Buy Value | Transaction Cost | Current Price | Current Value | Sell Value | Profit/(Loss) |

| LNVGY | 5 | 19.22 | 96.10 | 7.00 | 17.9 | 89.50 | (13.60) | |

| LNVGY | 2 | 17.90 | 35.80 | 7.00 | 17.9 | 35.80 | (7.00) | |

| EA | 9 | 13.77 | 123.93 | 7.00 | 22.02 | 198.18 | 67.25 | |

| BKS | 9 | 13.40 | 120.60 | 7.00 | 19.83 | 178.47 | 50.87 | |

| ZIP | 9 | 12.16 | 109.44 | 7.00 | 0 | – | 83.97 | (32.47) |

| GLUU | 25 | 2.29 | 57.25 | 7.00 | 2.77 | 69.25 | 5.00 | |

| AMZN | 1 | 273.63 | 273.63 | 7.00 | 264.12 | 264.12 | (16.51) | |

| AMZN | 1 | 264.12 | 264.12 | 7.00 | 264.12 | 264.12 | (7.00) | |

| SBUX | 4 | 58.56 | 234.24 | 7.00 | 63.55 | 254.2 | 12.96 | |

| TOTAL | $ 1,315.11 | $ 1,353.64 | $ 59.50 |

Not much exciting going on this month. I’m “up” about $59.50, on my total investment of about $1,300 , about a 4.5% increase, once my buying fees are taken into account.

If you'd really like to get serious about investing, I would consider a simple index fund approach rather than trying to pick individual stocks. Even the professionals lose to simple indexes, so in my opinion trying to pick stocks is a losing proposition. Index investing is not only more effective, but much simpler and less time consuming. A good place to start if you'd like to learn a little more is here: http://www.bogleheads.org/wiki/Getting_Started.