Welcome to the first Sunday Evening Post of 2013. I have got new goals and a new format that I am hoping will help me focus on what I want to focus on this year- in blogging, every day finances, and my side hustles.

Let’s start with the weekly tracking. I track every penny we spend on my spreadsheets. I don’t really need to do it here, too. Instead, what I want to make more visible is whether or not we are in budget in key spending categories. I’ll be tracking both for the month and for the year (since some categories are set up to balance out over the year, not be spot on every month). And it won’t be every budget category I have, but the ones that are more discretionary: groceries, house (home improvement, kitchen gadgets, new linens, etc), allowance, and eating out. While other categories like pets (as in vet bills), medical, and bills could be tracked, those are going to be paid no matter what, and if I need to make money up in the budget, it will be from these other categories.

|

Category

|

On Budget

|

|

Month

|

Year

|

|

Groceries

|

Yes

|

Yes

|

|

House

|

Yes

|

Yes

|

|

Eating Out

|

Yes

|

Yes

|

|

Allowance – E

|

Yes

|

Yes

|

|

Allowance – C

|

Yes

|

Yes

|

When it comes to goals, I intend to have 2 year-long goals in each blogging, finances, and side hustle (ie writing). There will also be at least one floating goal- that is, a goal I want to accomplish that I don’t expect to take all year.

Blogging

The purpose of these two goals is, yes, to grow my blogs, but also to support and highlight blogs and bloggers I enjoy. Just like I will be posting 2 new to me blogs every week in my round ups, the point here is to draw attention to blogs that others might not be familiar with. (Blog swaps will not count toward either of these goals.)

Write one guest post per month. It can be for personal finance or pet blogs, but one a month. In all the time I have been blogging, not counting blog swaps, I have managed 4 guest posts, so this is a somewhat ambitious goal.

The four previous guest posts are:

Guest post: Making Choices @Daily Money Shot (Aug 2011)

Puppies as Christmas presents @That Mutt(Dec 2011)

100 Words On: Donating to the Company Charity Drive @Len Penzo dot com (Nov 2012)

Holiday Games and Finance: What Can the Game “Dominion” Teach You About Money @Average Joe’s Money Blog (Dec 2012)

As you can see, I have managed to get a guest post up each of the last two months, so I have got some momentum built up.

Publish one guest post per month. Just like with making guest posts, I have only accepted 4 guest posts over the course of my time blogging. Two of them were this last year right around the time my MIL passed. (Thank you again Jana and Joe.)

I will accept guest posts for any of my blogs (100 Words On, Life by Pets, The Dog Ate My Wallet, and The Prose Passage). And if a personal finance blogger wants to write about their pets or a pet bloggers want to write about their writing, I’m all for it. Let’s get some cross genre action going here.

The point of this goal is not to accept those random email offers of guest posts or to get paid content. I want a chance to highlight on my blogs the writing of bloggers I like and support.

The four previous guest posts published here are:

From Jana @Daily Money Shot – At the Intersection of Work and Personal and Guest Post: Preparing for Baby

From Gin @Frugal Students – Real Estate

From Joe @Average Joe’s Money Blog – My Year Without Money

Writing

Writing fiction is my side hustle, though I have yet to make any money from it. I have found that I devote much more time to the blogs than I do my fiction, though, because I am on a schedule. I feel accountable to my readers to get posts up when I say I will. And because I am a procrastinator, deadlines are a must for me. I get the energy I need to work on something from an impending deadline.

I am hoping to transfer the power of those two things- accountability and deadlines, to my fiction this year.

Submit at least one piece to a paying venue per month. Duotrope.com, the site I use to find markets for my work, went from being a free site to a paid subscription this year. I went ahead and paid for a year, in order to help motivate myself. I managed to submit 5 pieces last year. But I’m going for a minimum 12 this year.

I have two possibilities for this month. One I am certainly submitting to (deadline Jan 31) and one I’m thinking of submitting to (also Jan 31 deadline).

Complete the first draft of my novella and start edits. My biggest concern with submitting short pieces to venues is that I will let my longer work sit on the shelf, the long term goal ignored for the short term. So I am going to track that here, too. I’m about a third of the way into the story, and I know where it’s going, so I just have to write it. (That makes it sound so easy.) I need to hold myself accountable to this work, as well.

Finances

A lot of financial goals will actually end up as floating goals- ie they will be things I expect to complete well before the year is out. But I do have some long term financial goals that I think will work for year-long tracking.

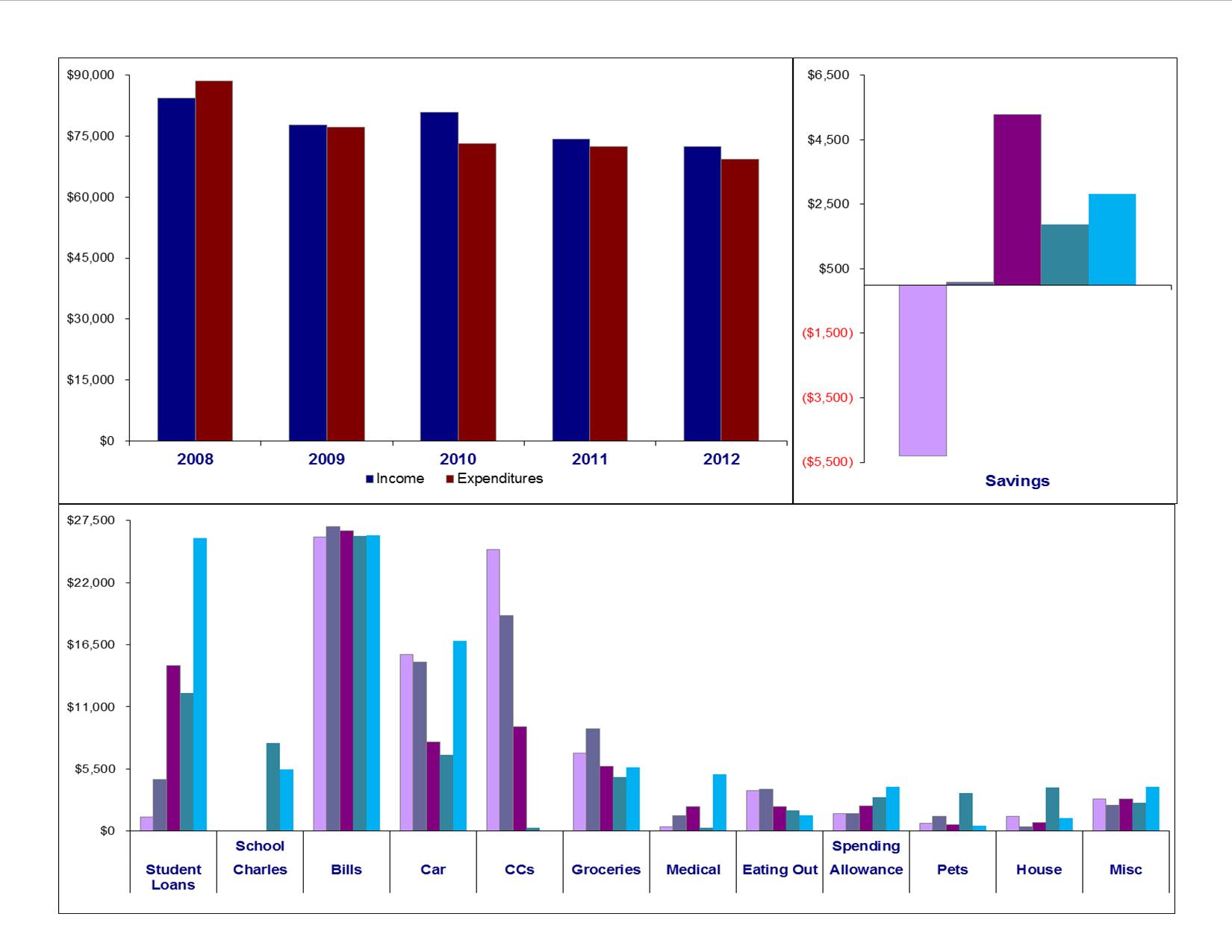

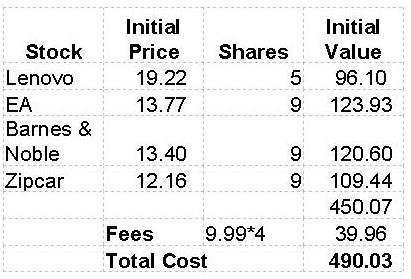

Create and track a practice stock portfolio. I don’t have any money in the budget this year set aside for investing outside of my 403(b), but I do want to get to that point. I don’t know a whole lot about investing, but I have always loved following the stock market. I am going to give myself X amount of dollars a month to invest. I’ll put some money into well-known companies, but I’ll also use tips from some of the investing blogs out there to find some sleeper investments.

Once per month, I’ll post my investments, progress, and research into a different investment site or option. And hopefully I feel comfortable enough to divert some dollars into investing in 2014.

End the year “on budget” in the categories I’m tracking. Groceries, eating out, and allowance are the three categories we are most likely to go over. In fact, based on going over last year, I raised our budgeted amounts for this year. So I really, really want to stay in budget this year.

Floating Goals

Refinance the house. There’s a possibility the house could appraise high enough for us to buy up to 20% equity within three to four months. There’s also the possibility it will appraise for low enough that we’d be $30k underwater. Either way, though, we are paying a 6% interest rate on our mortgage, despite both of us having credit scores over 760 and a debt to income ratio around 22%. We need to fix that. Even if we end up paying PMI, we could lower our mortgage payments by a few hundred a month. This needs to be done ASAP.

Replace all the windows in the house. This won’t happen until spring or summer, but I want to get it listed now because it was one of my goals for last year and fell by the wayside. I need to keep this on the radar. Our plan will be to secure 0% financing (one year same as cash type deal) if at all possible. Otherwise, we’ll pay cash up front.

Publish new photography/flash fiction book. This was a goal I had last year that had to be set aside due to everything going on in the life of the artist I want to work with. Her life has settled somewhat, so I’m hoping to get traction on this. But if we can’t start working sometime in the next couple of months, I plan on finding a different artist/photographer to work with and move forward on a book.

No matter who I work with, I’m actually hoping to fund this project through Kickstarter.

I know it’s Monday morning. I had been intending on posting last night when I got home, when I thought I was going to get home a little after 8pm. Instead, I got home after 10:30pm. Why you might ask? Because Seattle just had its coldest weekend of the winter, and my bio-diesel powered car sat outside in it. The fuel got all gummed up and wouldn’t start. C had to come pick me up from my friend’s house. Luckily, that friend then let us push the car into her garage to warm up, and we’re hoping to be able to go pick it up today. And yes, we will be taking said friend and her awesome husband out to eat for their hospitality and assistance.

I know it’s Monday morning. I had been intending on posting last night when I got home, when I thought I was going to get home a little after 8pm. Instead, I got home after 10:30pm. Why you might ask? Because Seattle just had its coldest weekend of the winter, and my bio-diesel powered car sat outside in it. The fuel got all gummed up and wouldn’t start. C had to come pick me up from my friend’s house. Luckily, that friend then let us push the car into her garage to warm up, and we’re hoping to be able to go pick it up today. And yes, we will be taking said friend and her awesome husband out to eat for their hospitality and assistance.