5 Years of Financial History

What you’ve all been waiting for, my financial graphs updated with 2012 data…

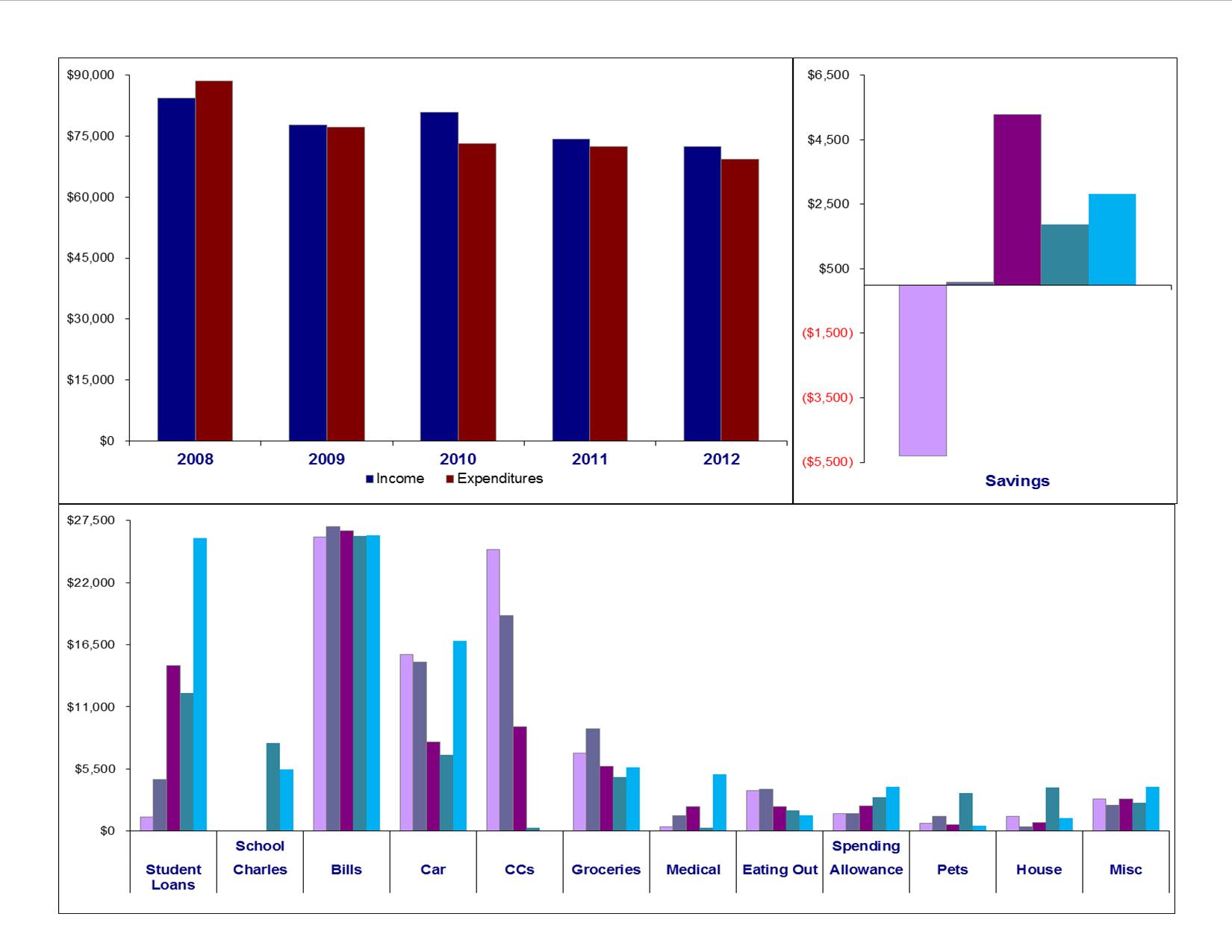

Our income went down a little bit, but we expected that. It was the first year we had no unemployment. However, our spending went down even more than our income and our savings definitely went up.

Our income went down a little bit, but we expected that. It was the first year we had no unemployment. However, our spending went down even more than our income and our savings definitely went up.

For the first time ever, we spent literally $0 on what I called credit cards. Instead, every month the cards were paid off completely and the charges were placed in their appropriate category.

Groceries went up a little, but we had a 3rd person in the house for the whole year. Our eating out spending was the lowest it has been in 5 years, even if we did go over budget. Allowance and Misc spending was up, though the Misc is where the $3,000 we lent to my brother was categorized, and accounts for the majority of that spending.

Overall, I am very happy with our 2012 financial picture.

I'm a huge fan of looking at progress over a long period of time. Way to go! I think it gives you bigger insight as to your financial situation than just looking a month or even a year at a time. So often, we think we're just plodding along, but then looking at 3-5 years, many have doubled their retirement accounts or even their net worth, or knocked off a third of their debt. These things are no small accomplishments, and when seen like that, it can provide motivation to move forward that might otherwise be lacking if you just focus only on the smaller periods.

For me, I think the main lesson is that C and I don't need more money. We used to bring in more money, and yet, we're in the best financial shape of our lives. It makes it easier for me to avoid lifestyle creep when I do get raises and to put that money aside for something "better".