Finances

-

A Review of My Side Hustle (Part 1 of 3)

I have been doing my side hustle for a little over a month now, and naturally, I have some thoughts. Let me start by saying, I am overall happy with the process. I have gotten to read some really interesting books that I would not have noticed otherwise. There has also been one book that I could not finish. It just bugged me too much. But that is not the fault of Online Book Review. (And while it seems from the reviews that many people agreed with my issues, many others did not and enjoyed the book tremendously.) Now that I have said something positive (and honestly, my overall experience…

-

New Page & Side Hustle

Nowadays, a lot of people have “side hustles”, ways to make money alongside their regular job. These used to be called “second jobs”, but that was before the gig economy. And for a lot of bloggers, their blog is their side hustle, at least until they can grow it to the point of it being their primary job. That is not me. I thought, way back in the day when I was managing four active blogs, that it might be. But then I realized that blogging was an enjoyable hobby for me, and trying to turn it into a money making device kind of sucked the fun out of it.…

-

College and University Funding Models part 3 – Return to the 70s

The second of my proposed funding models is also my preferred funding model, and in the end, the hardest one, in my opinion, to achieve. Because achieving it will take a whole lot more than the states just willing to throw more money at higher education. Honestly, I think the best funding model for state universities would be a return to the funding levels the states had in the 1970s. This was the time period when students could afford to pay for their tuition by working part time during the school year, maybe full time during the summer, at minimum wage jobs. Maybe they take out some small student loans…

-

College & University Funding Models part 2- Public Education

As mentioned last week, the first of the alternate funding models I live for universities is the public education option. First, let me be clear that I am only talking about public universities, those that are already funded via state budgets. Private and religious universities, like Harvard and Notre Dame would not fall under this, and would need to figure out their own new funding model, if it came to that. What are the benefits of the public education option? Well, that makes post-secondary education, up to the Bachelor’s degree level, free for everyone in the state, not just the economically disadvantaged. Because middle class families have difficulties paying for…

-

College and University Funding Models (part 1)

If you have been reading this blog and paying attention to the pictures I post, you have probably figured out that I work at a major public university in Washington state. In fact, I am a department administrator, meaning I handle finance and human resources for an academic unit at the University. It also means that University funding models are something I spend a lot of time thinking about. And not just me, at the professional conference I was at last week, one of our keynote talks was on the future of funding of public institutions of higher learning, and what models we might want to look at, as state…

-

Let’s Talk About Emergency Funds (part 2)

This is a continuation of the post began on Wednesday about the importance of Emergency funds, and how much you need to have in one. But what about those who say you should have 3-6 months worth of living expenses set aside? This is an emergency fund for people who are further along in their financial journey. They are not living paycheck to paycheck, and their debt is low interest and easily manageable. And the 3-6 months living expenses is on the theory that if you lose your job, you will have plenty of time to find a new one. This is not a bad idea, but this forgets that…

-

Let’s Talk About Emergency Funds (part 1)

Monday was tax day, so this seems like an appropriately themed week to return to my roots as a personal finance blogger. I had been considering running an updated version of my You Are Not Paying 35% in Federal Taxes from 2016, partly because I paid a lot more in taxes this year than any previous year and still did not come close to paying 35% in federal taxes, but honestly, I just never found the time to sit down with the numbers. And then, another topic came up. A lot of the time, when I write about finances here, you will see me refer to Stacking Benjamins. Stacking Benjamins…

-

Average Joes Deserve to Retire, Too

I originally wrote this post in November 2011, around the time of Occupy Wall Street. On some level, I miss Occupy Wall Street, because I hate the idea that you are not supposed to talk about finances in “polite company”. I hate the fact that we are all so busy keeping up appearances, that we let those appearances drown us in debt, or make it next to impossible to retire. It was refreshing (to me) to have a time when the country was actually focusing on our collective financial health. This is also part of why I love Alexandria Ocasio-Cortez – not because I agree with everything she says, but…

-

Salary History, Yes or No?

I like talking about money. I think talking about personal finances is important. I disagree firmly with the idea that polite company does not discuss money. Money is hugely important in all of our lives. It is a major factor in decisions we make every day. And like the ad campaign says “the more you know…” I like talking about money so much that I used to have a blog dedicated to personal finance. I have been an active participant on a money focused message board for almost 10 years. When students in my department ask me how much money I make, I give them an actual answer. And yet,…

-

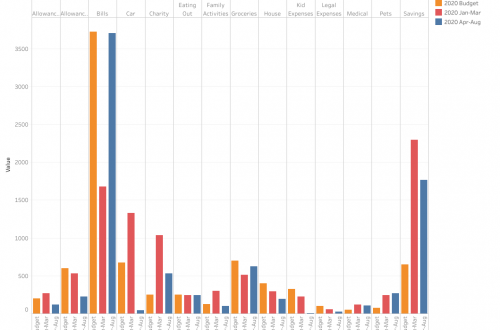

Blast from the Past: A Budget is NOT the First Thing You Need

Originally published April 14, 2011 on The Dog Ate My Wallet. Edited and updated on May 25, 2016. Let us start with the very basics. Everyone always says you need a budget, and you need to stick to it. Which is generally good advice, but not if you do not have the tools to create a realistic budget. Without the right information, people end up creating budgets that will not get them where they want to go or that they cannot stick to. And that is if they even create a budget in the first place. So what do you need before you create a budget? Information. For an entire…