Family Finances: 2008 vs 2020

Twelve and a half years – that is how long I have been writing about personal finance, or at least my personal finances. In January 2008, I started a friends-only LiveJournal specifically for sharing personal finance information and perhaps for generating conversations. I will be honest, I did not keep up on the LJ for very long, though I kept writing on my other LJ until October 2010. I started to write about personal finances on a blog I called Baking the Budget in April 2011. Around the start of 2012, I changed the name to The Dog Ate My Wallet. It was never a big blog, but it’s the blog that I signed up on Yakezie with and went to FinCon to for.

The personal finance blogs that became big were blogs that could offer people solid financial advice around investing, or the financial independence movement, or had dramatic stories of getting out of debt. We had debt, but our story was never dramatic. It was more of a slog, one filled with almost has many backslides as steps forward. But not being a star in the personal finance blogosphere never bothered me. I met a lot of really amazing people who also taught me a lot. And the truth is, I like writing about money.

Ever since I transitioned to Dear Alien Anthropologists, I have not really written about our finances. And I miss it. So today I thought I would look back at some of my earliest writings about money and share a bit about how far we have come.

| January 2008 | July 2020 | |

| Household Income: | $5,600/month | $7,700/month |

| Home equity: | $74,500 | $175,000 |

| Monthly Payments | ||

| Mortgage Payment: | $1,750 | $3,250 |

| Car Payment: | $800 | $0 |

| Student Loans: | $100 (undergrad only) | $0 |

| Household Bills: | $440 | $475 |

| Car Insurance: | $210 | $100 |

| Grocery Bill: | $630 (2 adults, 2 dogs) | $580 (3 adults, 2 dogs) |

| Credit Card Debt: | $600 | $0 |

| Eating Out: | $300 (2 adults) | $250 (2+ adults) |

| MIL Support: | $250 | $0 |

| Savings: | $25 | $1,950 (includes ROTH) |

| Gas: | $190 | $100 (pre-Covid) |

| Total: | $5,005 | $6,605 |

| Debt | ||

| Mortgage: | $225,500 (6%) | $522,500 (3%) |

| Car: | $23,300 (2.9%) | $0 |

| Student Loans (UG): | $19,350 (3.5%) | $0 |

| Student Loans (Grad): | $39,000 (0% – in school) | $0 |

| Credit Cards: | $13,250 (8% avg) | $0 |

| Non-Retirement Savings/Investments: | $10,025 | $12,675 |

Over the last 12.5 years, our income has gone up 38%. We have only increased our monthly payments by 32%, and that includes an increase of money going to savings of 780%. Our overall debt has gone up, but it is now only mortgage debt, at a pretty good interest rate.

The piece of information I do not have from 2008 is what our retirement savings looked like. Neither of us had a ROTH, and at the time, I was not enrolled in my employer 403(b) plan, though C was enrolled in his employer’s 401(k), and I had an old 401(k) from my previous employer. We currently have retirement savings of around $220k, after taking a substantial early disbursement 2 years ago to have earnest money to buy our current house.

We finally got out of credit card debt in 2010.

In 2012, after my MIL passed, we used the life insurance to pay off the graduate student loans.

We did not pay off the undergraduate loans until 2015, after we sold two properties (one being my MIL’s condo) and only purchased one.

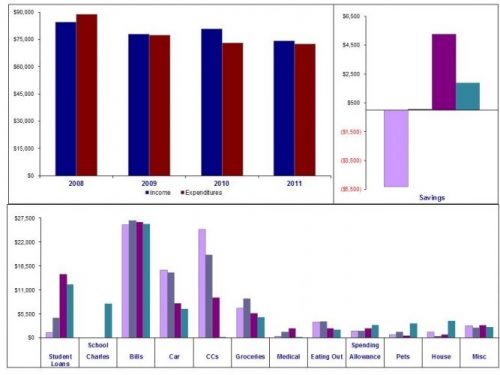

Another fun note, this is not the first time I have looked back and compared current spending/bills to those in 2008. At the start of 2012, I declared 2011 = Winning, and shared the charts that are the picture for this post.