Blast from the Past: A Budget is NOT the First Thing You Need

Originally published April 14, 2011 on The Dog Ate My Wallet. Edited and updated on May 25, 2016.

Let us start with the very basics. Everyone always says you need a budget, and you need to stick to it. Which is generally good advice, but not if you do not have the tools to create a realistic budget. Without the right information, people end up creating budgets that will not get them where they want to go or that they cannot stick to. And that is if they even create a budget in the first place.

So what do you need before you create a budget? Information.

For an entire month, maybe two months, track every single little penny that comes into or goes out of your hands. Write it down. You have to know how much money you have and where it goes. Be honest during this time. Do not decide not to buy something because you do not want to write it down (though if that is the case, think about whether you really need it); do not pay extra on a bill when you normally pay the minimum. That corrupts your data. Just like when talking to your doctor about health issues, your financial tracking needs to be a complete and honest picture of your spending habits.

Most people know the incoming amounts, but very few people (who are not already on the budget journey) actually know where all their money is going. This is why you track. Did you realize that you spend $5 on coffee every morning without thinking about it? Have you thought about the fact that you are running to the grocery store almost every day, getting just one or two items here and there? Have you paid any attention to what your cell phone bill really is? How much do you really spend on all those activities for the kid(s)?

Once you have the data, you need to do something with it. Create categories for your spending.

My categories are:

2011

- Student Loans

- College

- Bills (includes mortgage, utilities, cell phone)

- Car (car payment, gas, insurance, parking)

- Credit Cards

- Groceries (food & household items)

- Medical

- Eating Out

- Allowance (clothes, books, movies, etc)

- Pets

- House (home improvement, kitchen gadgets)

- Miscellaneous

- Savings

- Income

The important thing is that you create categories that work for you. But be aware that you might someday need or want to change your categories- sometimes in the middle of creating the budget or even while categorizing. Honestly, I should probably make Starbucks/Chai its own category. I review mine at least once a year to decide if I am still tracking things in a way that makes the most sense for us. And I make changes to them when it makes sense to do so.

2016

- Allowance (for each of us)

- Bills

- Car (gas, parking, insurance, maintenance)

- Eating Out

- Family Activities

- Groceries

- House

- Kid Expenses

- Medical

- Pets

- Savings

- Income

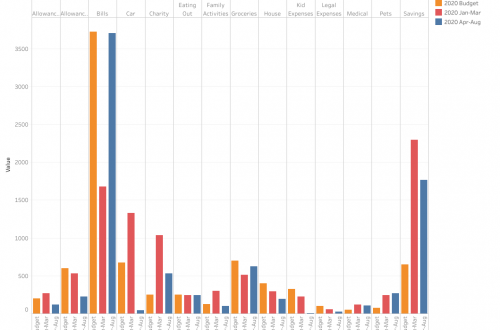

On some level, the changes to my categories tell you quite a bit about how our lives have changed. We no longer have student loans to pay, and C has completed college. We also do not carry balances on the credit cards, so each expenditure gets categorized individually, versus being lumped together. However, we also now have a child, so have new categories for that.

Now, I use excel for my checkbook and tracking spending. Mostly because then I never have to do the math. But I am also enough of a geek that I color code everything. This way, even without looking at the budget spreadsheet (which automatically imports the data from the checkbook spreadsheet) I can tell at a glance if we are eating out a lot, or running to the store more often than we would like.

So there you have it- steps one and two, and no budget to even think about yet. Track your money. Know what you spend your money on. Even if you never get around to creating a budget, simply being aware of how you spend your money can help you make changes if you need to.