I need a break from serious topics at the moment, and I love the “getting to know you” type posts where bloggers give a list of things about themselves that we don’t already know. At the same time, I’m not certain I could really give you that kind of list, because I’m pretty open about things. Most things that I could think of to put on that kind of list, I’m pretty certain I’ve already mentioned elsewhere. And while I could to an “interesting things about me” recap post, I also decide that would be too much work.

Instead, I want to tell you the story of my first credit card purchase.

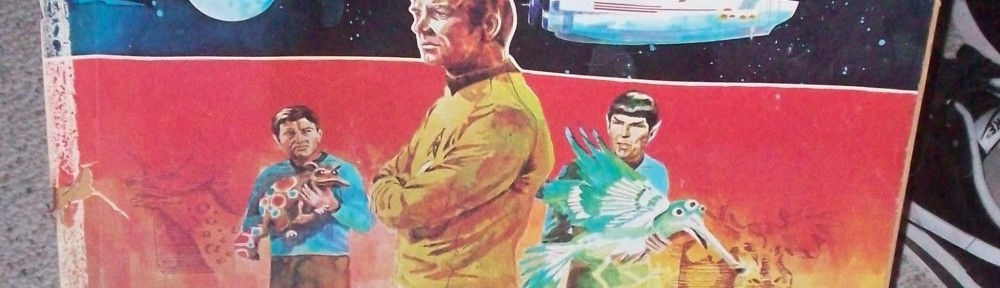

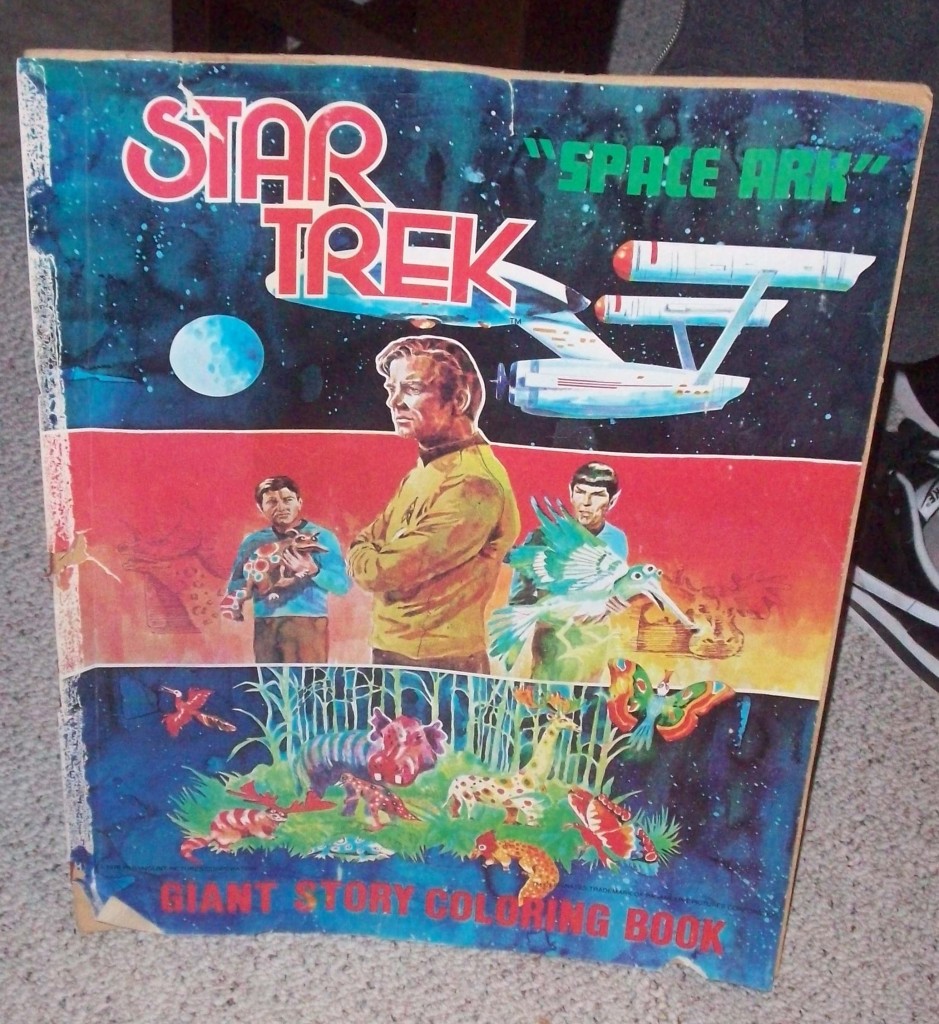

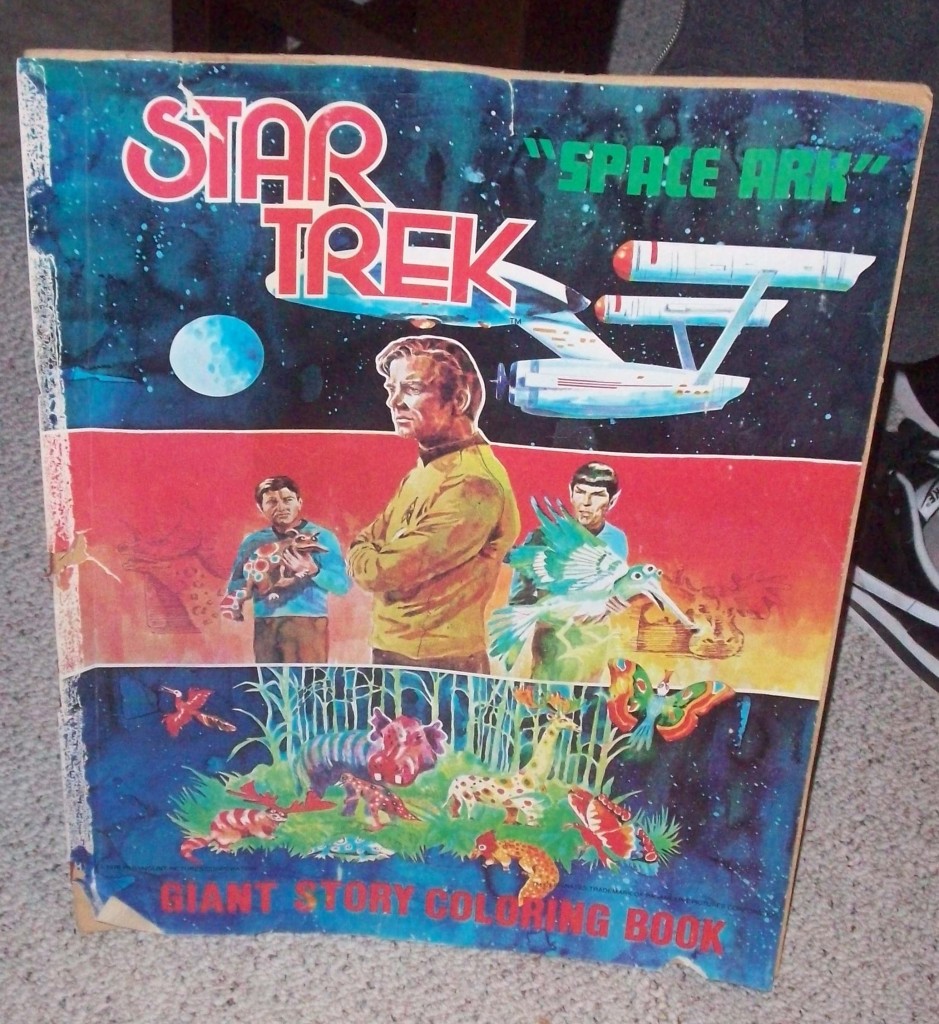

the coloring book I tried to throw out this weekend, but that C "saved"

Applying: I was in college. I really had no intention of getting a credit card. My older brother was already in over his head, and I didn’t want that to be me. But then the day came when I iddn’t even have the $1.06 for breadsticks from the Pizza Hut in our student union. I was really hungry, and this one credit card was giving away large bags of M&Ms.

I had avoided cards giving away t-shirts and baseball caps and Frisbees, but I was hungry, and these were large bags of peanut (protein!) M&Ms.

I signed up for the card.

Activating: When I got the card, I let it just sit there on my end table. After all, I had no intention of using it. I’d just needed the food. But then came the January day when I decided to ride along with a couple friends as we drove another friend back to school in Ashland, from Reno. Let’s look at that plan again- up 395, though Susanville and some state parks, on narrow windy roads, then to I-5 and Ashland. In January. And we were driving back the same day. (By the way, due to weather, we came back I-5 to Sacramento and then I-80 back to Reno, which, even while much more likely to be plowed, does require going over Donner pass.) Given the circumstances of the trip, I decided it would be prudent to activate my card. This was certainly a situation where an honest emergency need could come up, which was, as far as I was concerned, the only real reason to use a credit card- an emergency.

Off we went on the trip, the credit card secure in my wallet.

I did not use the card on that trip. It was not needed. But I did not move the card out of my wallet, either.

The First Purchase (and some a lot of geekiness): A few more months passed. There was a Star Trek convention. I do not think there was a charge to get it, but I do not remember.

I do remember George Takei was a guest, and that this was at the time that all Trekkers (I am a Trekkie) hated Shatner. During the Q&A session with Takei, someone mentioned that there was a scene in one of the movies where Sulu receives his own command, and hat Shatner had gotten it cut from the movie, and would Takei re-enact the scene for us. Takei graciously refused. (This event is what made him my favorite original Trek star.)

I should mention that this convention took place shortly after Generations came out, and Generations was NOT the movie in question.

Anyway, at the time, I was playing the Star Trek Collectible Card Game. (My Romulan deck was my favorite.) And at the convention, they had entire boxes of boosters for really great deals. Only, I was still a poor college student, living off of working 20 hours a week, and left over money from scholarships. My mom paid my grocery bill, but I paid my own rent (and rent was more than a single paycheck, which is another financial lesson I learned in college. I never wanted any bill to be more than a single paycheck).

But payday was soon. I would totally have enough money on payday to buy a box of boosters. And, I had a credit card in my wallet.

That’s right, my very first credit card purchase ever was a box of Star Trek: The Next Generation Collectible Card Game booster packs.

The Fall Out: I did not, I am sad to say, pay off the entire bill when it came. No, I was a poor college student, and that “extra” money from my paycheck had gone to silly things like instead of only spending $1.06 on breadsticks for lunch, I spent a whole $5 on a personal pan pizza, breadsticks, and a drink. (I would kill for a similar deal now, but at the time, that was a serious splurge- basically the money for an entire week’s worth of lunch spent in one day.)

After that, the credit card was used for other things that weren’t paid off right away, and it grew to be a very nasty lesson for me in credit card use. It did not teach me to pay off my credit card every month (that had to wait 15 years for DH to be laid off and my budget to go to hell), but it did teach me not to miss a payment, and not to only make minimum payments, which is something, at least.

Not my autographed picture

More Geekiness: And now, because it is tangentially related, and I’m in a bit of a Star Trek mood, let me tell you my favorite Trek convention story.

It was a few years later. I was meeting friends at a convention at which John DeLancie was the featured speaker. Trek timeline wise, this would have been right after Q’s first appearance on Voyager.

I walked from the university to the casino hosting the convention (remember, I lived in Reno, everything happened in a casino), and got in the first set of elevators to go up to the convention floor. I other people got on and off at a different floor. I wasn’t really paying attention to the other people in the elevator, when I heard this guy with a cool accent speak. (For the life of me, I can’t remember if it was British or Australian or what, I just remember it was the accent that drew my attention.) I looked toward the accent, and then immediately forgot about it, because the guy with the accent was talking to JOHN DELANCIE! I was in an elevator with John DeLancie!

I wanted to say something, but only two thoughts popped in my head.

1) “Oh my God! You’re John Delancie.” I decided this would be the stupidest possible thing to say as he certainly knew who he was.

2) “I never through Jon Luc a parade” which was a line from his Voyager episode. I couldn’t bring myself to say it though, because it was just too geeky and there were other people on the elevator.

And then the elevator stopped at the floor for the Trek convention. I got off. John DeLancie did not. I searched out my friends, barely able to keep from jumping up and down, to tell them about being on an elevator with John DeLancie!

I paid for an autographed picture of him at that con, too. I am certain I still have it somewhere.

from the Q Voyager episode