Finances

-

Blast from the Past: My Money Philosophy

This was my first post on The Dog Ate My Wallet. Similar posts had appeared on my earlier (and since deleted) blog Baking the Budget, and a LiveJournal account also called Baking the Budget. This has been my general money philosophy for a long time. Oddly enough, it mirrors my philosophy about a lot of things (and kind of explains why I am a blogger) – which is that the world would be an easier place for us to navigate if people were more willing to talk about the difficult and taboo subjects. And I am in a very different (and better) place financially in 2016 than I was in…

-

You Are NOT Paying 35% in Federal Taxes

On April 15, 2015, a guy named Mitch Wade posted a series of pictures on Facebook regarding taxes, and how much the government steals from the ordinary person. I did not see it in 2015, but it has made its way around my wall this tax season. And let me be honest, it is a TERRIBLE infographic. It just is. Mostly because it is misleading enough that it might as well be lies. I used to write a personal finance blog. Financial literacy is something that is incredibly important to me. I honestly believe that as a country, we would be in infinitely better shape if we got rid of…

-

Instead of College, Can We Talk About Daycare?

Let me say that I appreciate that Sanders has pushed the conversation to the left. No matter who the eventual Democratic nominee for the President is, the conversation has been better because he has been part of it. At the same time, I realized the other day that I am mad at him. Not for being in the race, but for pushing the conversation toward universal college education, and forcing Clinton to respond specifically to that. As I have said before, I am not against universal college education. In fact, as a parent of a 6th grader, I am likely to benefit from it. But what if the conversation had…

-

Why Our Daughter Does Not Have a College Fund

For a lot of parents, the second they find out they are pregnant, they start thinking about saving for college for their little one. And it makes sense. College is expensive, and if we can help our kids start off their adult life with as little debt as possible, that would be great. Because the truth is, while student loan debt is often considered “good” debt, kind of like a mortgage, in that you are getting something for it, it has its negatives, too – especially if the student needs more than the federally guaranteed loans and gets some from private lenders. After all, if our kids get in major…

-

We Have the Money, We Need a Plan

Both of the Democratic candidates for President have put forward the idea of free college for America’s youth. Next year, Oregon will have very low cost ($50/term) for all community college students. Tennessee and Kentucky are both working on free community college for their residents, too. As a parent (and particularly as a parent who will only have half the time most parents do to save for college), I am a fan for free college – community college or a four year program. And I have seen the studies that say the plans put forward to pay for the program work. The money is there. I do not doubt that.…

-

This is Why We Need to Talk About Money

I used to have a blog dedicated to personal finance, and I still talk about finances here for one reason. I believe it is very important that we end the stigma on talking about money. Money is a necessity in the current world and not understanding it puts people at a significant disadvantage. If the only person who ever talks to you about how mortgages work is the shady guy trying to sell you a bad mortgage, then how are you supposed to know it’s a bad mortgage? On some level, the student loan crisis has been great for this. It has gotten more people talking about the costs of…

-

Our Prosper Experiment – 9 years in

You know that old saying about being able to make the statistics say whatever you want them to say? I have been thinking about that today as I have been working with the returns on our “investment” in Prosper, made back in March 2007. Since I have not posted about it on this blog before, I will give a very brief overview. For more details, you can click on the links to my 4 previous Prosper updates. In 2007, we had “extra” money lying around and decided to invest in peer to peer lending. We chose Prosper. We transferred over $3,000 and happily began making loans. Then over the course…

-

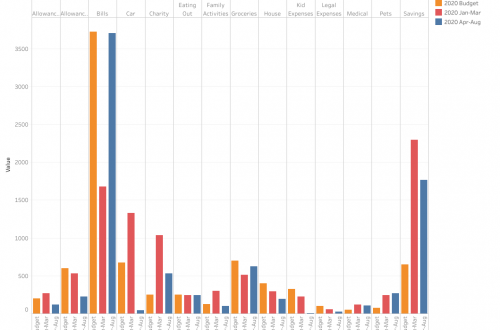

Doing What Works for Me

Back in my college days, I was really bad at keeping track of how much money I had left in my checking account. I would often assume that whatever the ATM said my account balance was, it was, even if I had written a check or two recently. It was not that I did not know how checks worked, it was just that I assumed everyone cashed them really promptly. Because I did not actually track how much money was in my account, I bounced a rent check or two. In fact, at one place, I had to start paying rent in cash because I bounced too many checks. And…

-

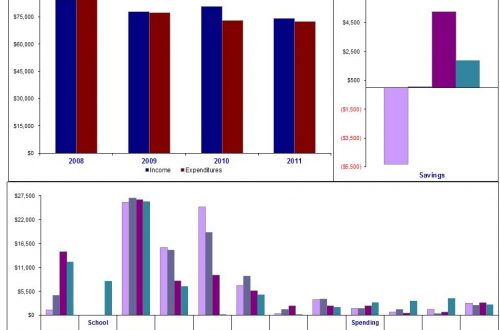

Six Years and $85,000 in Debt

Today I posted on FB about finally paying off the last of my undergraduate student loans. I called it an adult achievement. And it is. And I am really proud of finally getting those student loans gone, especially when I graduated from undergrad 15 years and 5 months ago. It is, in fact, a big deal. But the truth is, for me, this is about more than student loans. It is not actually about the last 15 years, but about the last 6 years. In 2009, C lost his job. At the time, we had over $70,000 in non-house debt, everything from credit cards and car loans to student loans.…

-

Inspired by Missing FinCon15

Starting today, a number of awesome people are descending on Charlotte, NC for FinCon15. I attended FinCon in 2012 and 2013, but have not been able to go the last two years. I miss the conference overall, but I really miss the people: Jana of JanaSays, Joe of Stacking Benjamins (and The Free Financial Advisor where he writes as Average Joe), and Kathleen of Frugal Portland (and now also Stacking Benjamins). Those are just three of the awesome people I have connected with, and stayed connected with. I want to make a plan to attend FinCon16. At the same time, I wonder if I can really call myself a financial…