How has the Pandemic Changed our Spending?

I am fascinated by the ways in which spending in our household changes over time, and especially now with the pandemic. I am not a $0 based budgeter, but in normal times the cushion is a few hundred “extra” dollars in the checking account at the end of the month (unless there is a specific plan for those dollars). For the last few months, it has been a few thousand extra dollars. (Which I have been sending to savings/investments as I’ve gotten confident they really are extra dollars and I am not missing something.) I decided to take a moment to sit down and look at how our spending has changed since the start of the shut-downs in our state, and then I decided to look at how our spending has changed from last year, too. Because it is interesting, at least to me. I am a nerd.

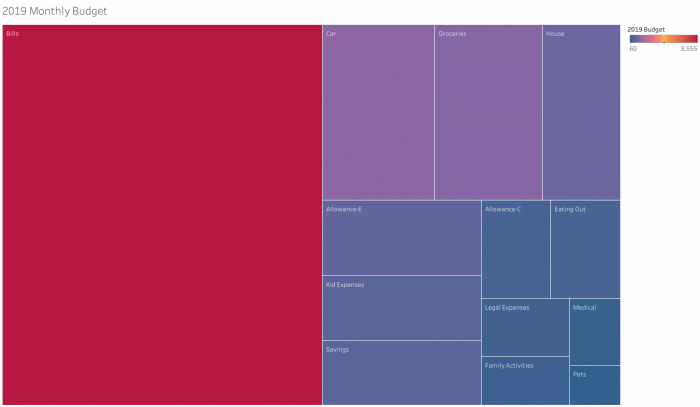

I then took all the data and made it visual with Tableau, because that is the kind of nerd I am. Let’s start by looking at a normal year. Here is what our monthly budget for 2019 looked like.

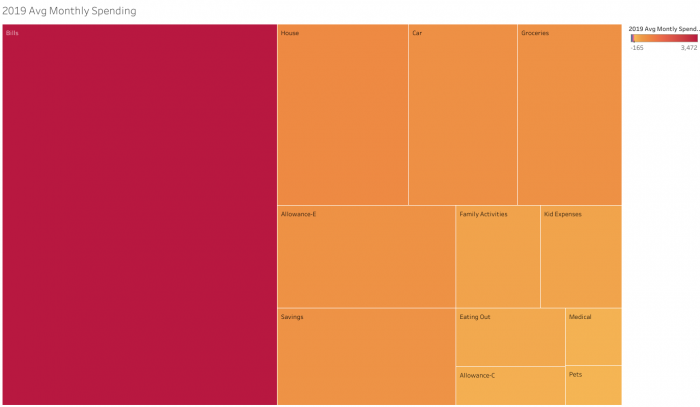

And here is what 2019’s actual spending looked like.

Basically, we spent less on bills than we expected and a bit more on everything else. Per the budget, I expected our biggest spending categories outside of bills to be groceries, our car, and the house, and I was right, though we spent more on the house (we moved in the week between Christmas and New Year’s Day) than I had planned and a little less on the car and groceries. I spent a lot more on my allowance, less on my daughter, and put a bit more in savings than we had originally hoped. I used the actual spending for 2019 to help develop our 2020 budget. One difference between the budgets is that we added a Charity category for 2020. We had been making charitable donations in 2019, but they had been classified as Family Activities.

(For an easy point of reference throughout these 2020 graphs, we are almost perfectly on budget for eating out, so that rectangle always represents the same amount of money.)

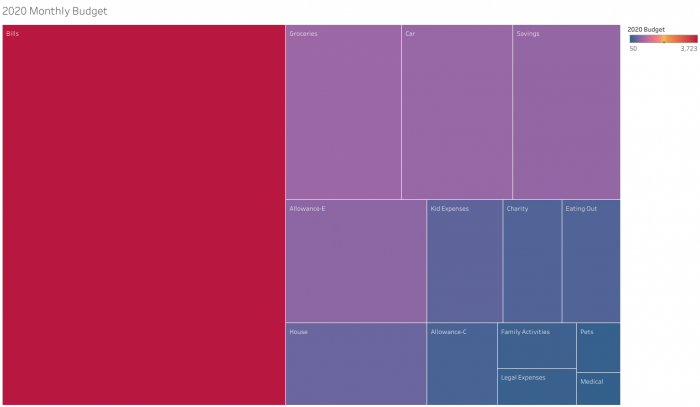

This year, the we expected most of our spending to once again be bills, followed by groceries, the car, and then savings. Based on last year, we actually upped my Allowance by quite a bit, and, now that we are settled, planned on a lot less spending on the house.

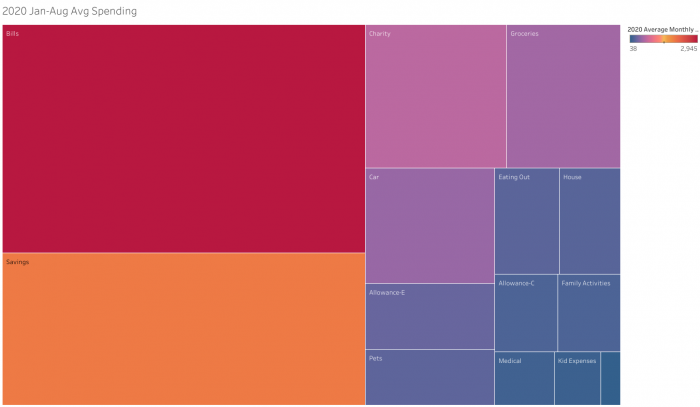

So how are we doing? All the spending for the rest of the month is pretty much planned and in my spreadsheets, so here is what 2020 looks like through the end of August.

We refinanced earlier in the year (and are in the process of doing so again) so had one less mortgage payment making bills less of an expense. We have seriously upped our savings and our charitable donations. So this lets us know where we are for the year compared to the budget, and it is pretty obvious that this is very different from the previous year.

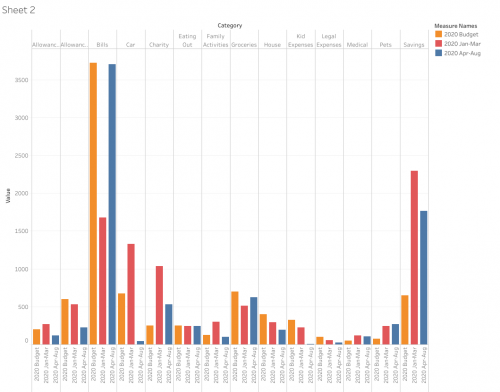

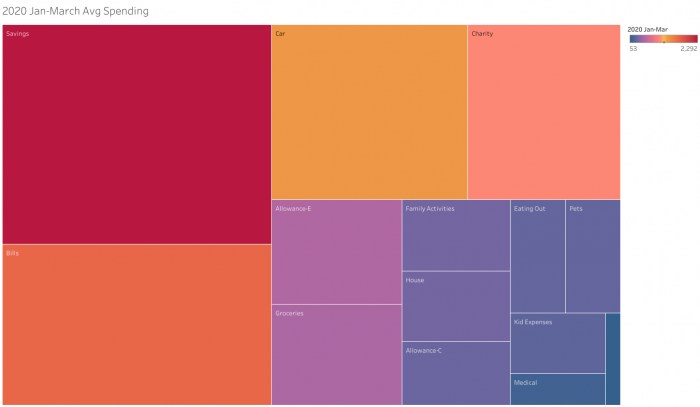

So the question is, how much has the pandemic changed things? I started working from home in mid-March. Just like now, all of our March spending was pretty much planned by that time, so I cut our spending in a January-March bucket and then an April-August bucket. This is what the year looked like pre-pandemic stay-at-home orders.

February was the month we skipped a mortgage payment and we used that money to start a 2019 ROTH IRA for C. In addition we got some other “refunds” from our previous mortgage. We took most of that money and put it in savings. This is why, for one quarter of the year, we actually put more money in savings than we spent on our monthly bills. We also had a major car service early in the year, but those happen and average out over time. it is also not surprising to see the charity category at the top as we made a number of charitable contributions using the credit cards at the end of 2019 and therefore paid those bills in early 2020. I also traveled at the end of February to visit my father, which is part of why my allowance spending is so high.

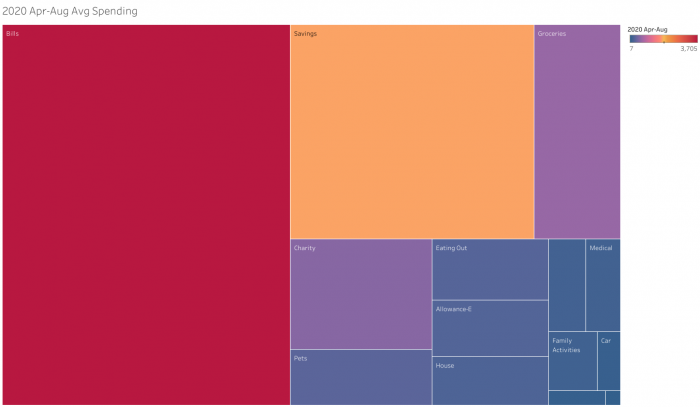

But things have changed quite a bit since we started staying home.

Some of the changes are not surprising. There have been almost no Kid Expenses because I am not traveling to visit my daughter. Less driving means very little spending on the car. I am pretty proud that we have been taking most of that “extra” money and putting it toward savings and charitable contributions.

Soon we will have another month of no mortgage payment because we are refinancing once again. And I just closed out a savings account that was not included in any of my tracking (it was left over from when I was a child, and with no activity, the credit union was getting ready to turn the money over to a state I have not lived in for over 30 years). Money from those two things will once again go almost entirely into savings.

2020 will not go down as a normal year in any sense of the imagination. But I am hoping that we will be able to take some of the trends in our spending and savings habits forward and make them our new normal.