The Stock Market Project- Month 2

It’s February! I get another $200 to throw at the stock market. This is exciting and depressing. You see, I’ve been reading some things about Amazon that I really like, so I’d like to be able to buy some Amazon stock, but it’s currently going for over $260/share. I don’t have enough to buy even one tiny bit.

In addition, in talking to some friends who work in the game industry, I decided that it would be a good idea to invest in a local mobile game company that happens to be publicly traded (not very many are). Glu Mobile (Nasdaq, GLUU), is only $2.29/share. For $209.97 (counting the money left over from Janunary), I could buy quite a bit of GLUU.

I decided to compromise. I bought 20 shares of GLUU and I’m saving the rest of the money for next month, so that I can afford to buy one, single, lonely share of Amazon. I still charged myself the $9.99 transaction fee, so I spend $55.79 this month and have $154.18 waiting to go toward my Amazon purchase next month.

Now that you know how I have spent this month’s allotment, I bet you are wondering how the stocks I bought last month- Lenovo, EA, Barnes & Noble, and ZipCar are doing. Would you believe that they all went up. Not by a whole lot, but by enough that as a group, they have now paid for the transaction fees to buy each stock. I am up (pure stock price) by over $52.

| Stock | Shares | Buy Price | Buy Value | Transaction Cost | Current Price | Current Value | Profit/(Loss) |

| LNVGY | 5 | 19.22 | 96.10 | 9.99 | 22.96 | 114.80 | 8.71 |

| EA | 9 | 13.77 | 123.93 | 9.99 | 16.87 | 151.83 | 17.91 |

| BKS | 9 | 13.40 | 120.60 | 9.99 | 13.97 | 125.73 | (4.86) |

| ZIP | 9 | 12.16 | 109.44 | 9.99 | 12.24 | 110.16 | (9.27) |

| GLUU | 20 | 2.29 | 45.80 | 9.99 | 2.29 | 45.80 | (9.99) |

| TOTAL | $ 495.87 | $ 548.32 | $ 2.50 |

I need to be up by over $20 each for them have earned back their purchase transaction cost and cover the selling transaction cost, and I’m not there yet. That, and I am in this for the long haul. Unless something major happens, I do not intend to “sell” any of my stocks this year. I want to track how well they do over the course of a year.

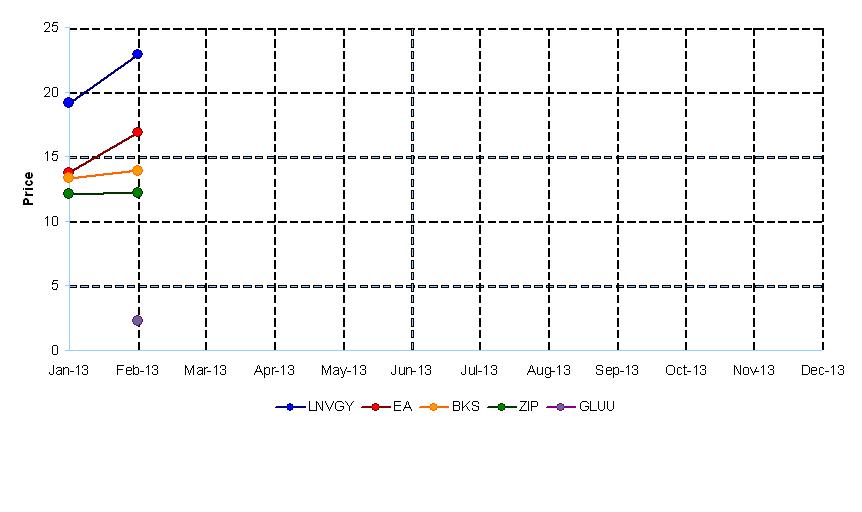

However, since we now have two moths worth of data, I was able to make chart!

So that’s the February update. Between trying to refinance the house and doing taxes, I haven’t had time to research any other online trading companies, so we’re sticking with e*trade prices for now.

So that’s the February update. Between trying to refinance the house and doing taxes, I haven’t had time to research any other online trading companies, so we’re sticking with e*trade prices for now.

[…] and track a practice stock portfolio. Post 2 went up on […]